According to NiceHash data, a halving will occur in the Bitcoin network in two days. Many investors make a lot of promises after this event. The reason is obvious: so far, it was the division of the reward for miners that drove the BTC price. But will it be the same now? I will try to answer this question.

Bitcoin: from a computer geek's toy to a financial revolution

Before we move on to the topic of halving, let's focus on bitcoin. Cryptocurrency has come a long way: from being basically a geek's toy used to buy pizza for fun, to a symbol of the new financial revolution. Where does this phenomenon come from? It comes from, among others: halving, i.e. the division of the reward for miners.

Ok, does it sound too complicated at this stage? I will now explain what all these terms mean.

Bitcoin works based on blockchain technology. It is a distributed, immutable ledger of transactions that is stored online and on many computers. Each block in the blockchain contains a set of transactions that are cryptographically secured. All blocks together are linked together by a unique identifier, a “hash”. In order to add a new block to the blockchain, miners, i.e. bitcoin issuers, must solve a complex mathematical problem, which requires significant computing power. This is how a chain of blocks (blockchain, block, chain) is created.

The concept of a miner is not ideal here, because it creates associations with people working with pickaxes and mining coal or gold. In the case of bitcoin, their role is more like that of accountants. They record transactions in the blockchain. They do this using excavators, i.e. specialized devices that solve the above-mentioned mathematical puzzles. In return, they get bitcoins. Thanks to this, they can cover the electricity bills consumed by the excavators. Of course, the surplus is their profit. Golden deal? However, there is a catch.

Bitcoin halving

I mentioned above that bitcoin is a symbol of the financial revolution. Why? As you, dear reader, have probably already noticed, there is no central bank or other centralized entity behind cryptocurrency. The issue takes place in a decentralized way – thanks to miners who compete to see who can solve mathematical complexities the fastest and receive bitcoin.

The supply of bitcoin is therefore independent of the government. It is not possible to suddenly print, for example, a million coins, as is the case with fiat currencies. In addition, the final supply of BTC is 21 million units. And it will never be like that again! As if that were not enough, a predetermined number of coins may also appear on the market at a certain time.

At this point we reach the halving. This is a process in which the reward for mining a new block in the Bitcoin blockchain is halved. At the very beginning of Bitcoin's existence as a project, the reward for mining (ahem, let's stick to this mining analogy) block was 50 bitcoins. After the first two halvings – in 2012 and 2016 – the prize was reduced. First to 25, then to 12.5 BTC. Currently – after the 2020 division – it is 6.25 BTC. And in two days it will be divided by 2 again.

How does halving affect the supply and price of bitcoin?

Reducing the reward for mining a block by half means that fewer bitcoins will be put into circulation. As a result, the supply of new coins will decrease.

The above may have serious consequences. Firstly, assuming that the supply will increase (as has been the case so far), the price of bitcoin will also go up in the long term (with adjustments, of course). In addition, miners will receive half as many bitcoins for the same amount of electricity. This means that they will have to sell them at a higher price. Otherwise they will go bankrupt.

Now the situation is special and different than, for example, 4 years ago. At that time, there were no spot BTC ETFs on the market. And this both in the USA and in Hong Kong (read: China). What does it mean? The fact that investors who did not invest in cryptocurrencies are slowly entering the market because they had some concerns. And they were unable to set up a BTC wallet on their own, and they simply considered bitcoin to be an asset that is not safe, since Wall Street giants stay away from it. Now that has changed. You can invest in BTC in a safe way (we buy an ETF unit, and the “physical” cryptocurrency will be stored for us by the issuer), and there is an element of trust on the part of the largest ones (well, if BlackRock has a BTC ETF, there must be something to it to be!).

All these factors together should give us a supply shock and a spike in the exchange rate.

Influence on the price in the past

It is easier to predict the future when you know the past well. Finally, let's go back in time and see how the BTC price behaved before and after previous halvings. Let's focus on the last two as we were already dealing with quite a large market.

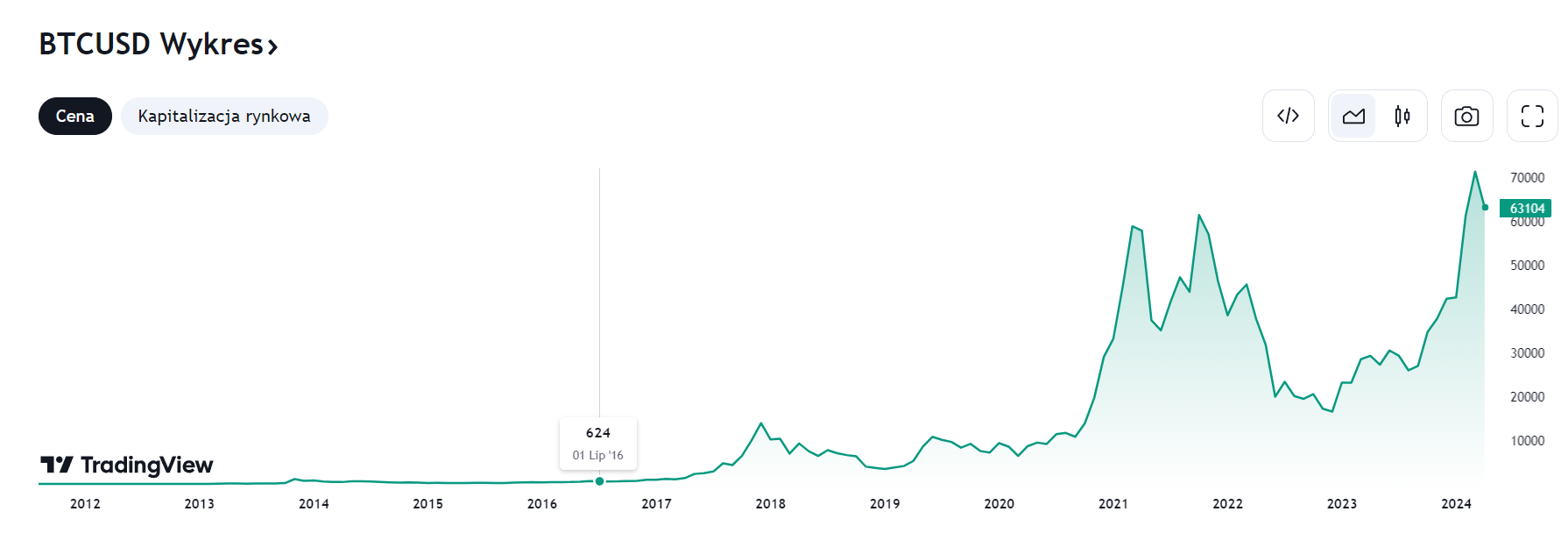

The penultimate prize distribution took place on July 9, 2016. A few days before the halving, 1 BTC was worth just over USD 600. This level remained more or less until October. And it started happening!

After a year, 1 BTC already cost approximately USD 3,000, and at the end of 2017 the cycle ATH reached USD 20,000.

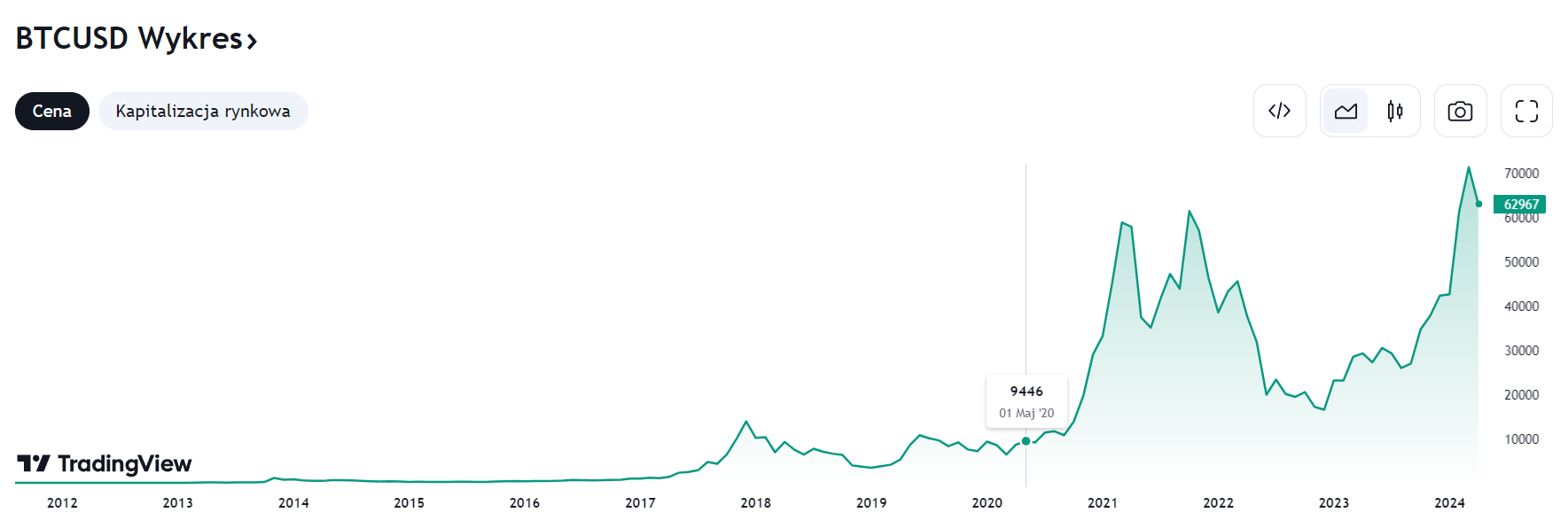

What happened before and after May 11, 2020? At the beginning of May, the price for 1 BTC was approximately USD 9,500. After the halving, the mountain climb began, ending with a peak near USD 70,000.

What does all this tell us? The fact that the division of the reward for miners is a catalyst for growth. In this cycle, it may work even more strongly, because the post-halving effect will include the purchase of bitcoins by ETFs.

I do not dare to quote the ATH of this cycle, but it can be assumed that bitcoin will surprise positively again.

Summary

Bitcoin halving is a key event in the cryptocurrency market. This phenomenon has a significant impact on the supply and price of BTC. Although the halving may be difficult for new investors to understand, its implications for the cryptocurrency market are undeniably significant. Therefore, anyone interested in Bitcoin should be aware of what halving means and how it may affect the future of this cryptocurrency.