Many experts point out that the current bull market in cryptocurrencies is different than the previous ones. According to Sebastian Seliga, an expert at zondacrypto, the main difference comes from the fact that institutions are entering the market.

zondacrypto says this bull market will be different

Many experts believe that the current BTC cycle will be different. The point is that large companies are entering the cryptocurrency market through ETFs. Sebastian Seliga from zondacrypto also thinks so.

In my opinion, the current BTC bull market is fundamentally different from the previous ones

– he pointed out in the message received by our editorial office. He added that the current increases are driven by demand from large companies.

Seliga points to specific data:

Last week, there were days when the daily demand for BTC in ETF funds exceeded the daily supply issued by miners by as much as 12 times, so fund managers had no choice but to buy BTC on the market (i.e. on cryptocurrency exchanges), which contributed to another wave of growth.

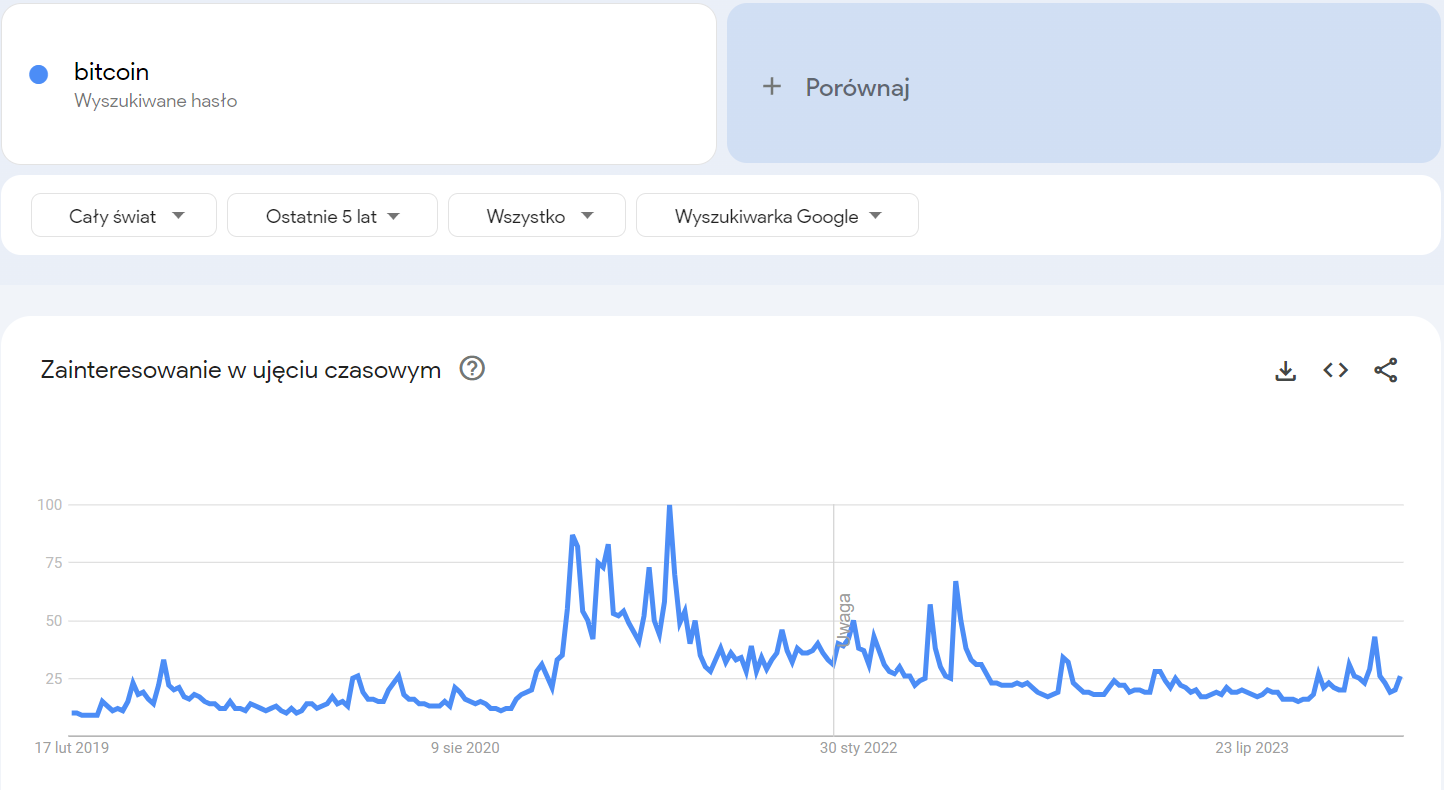

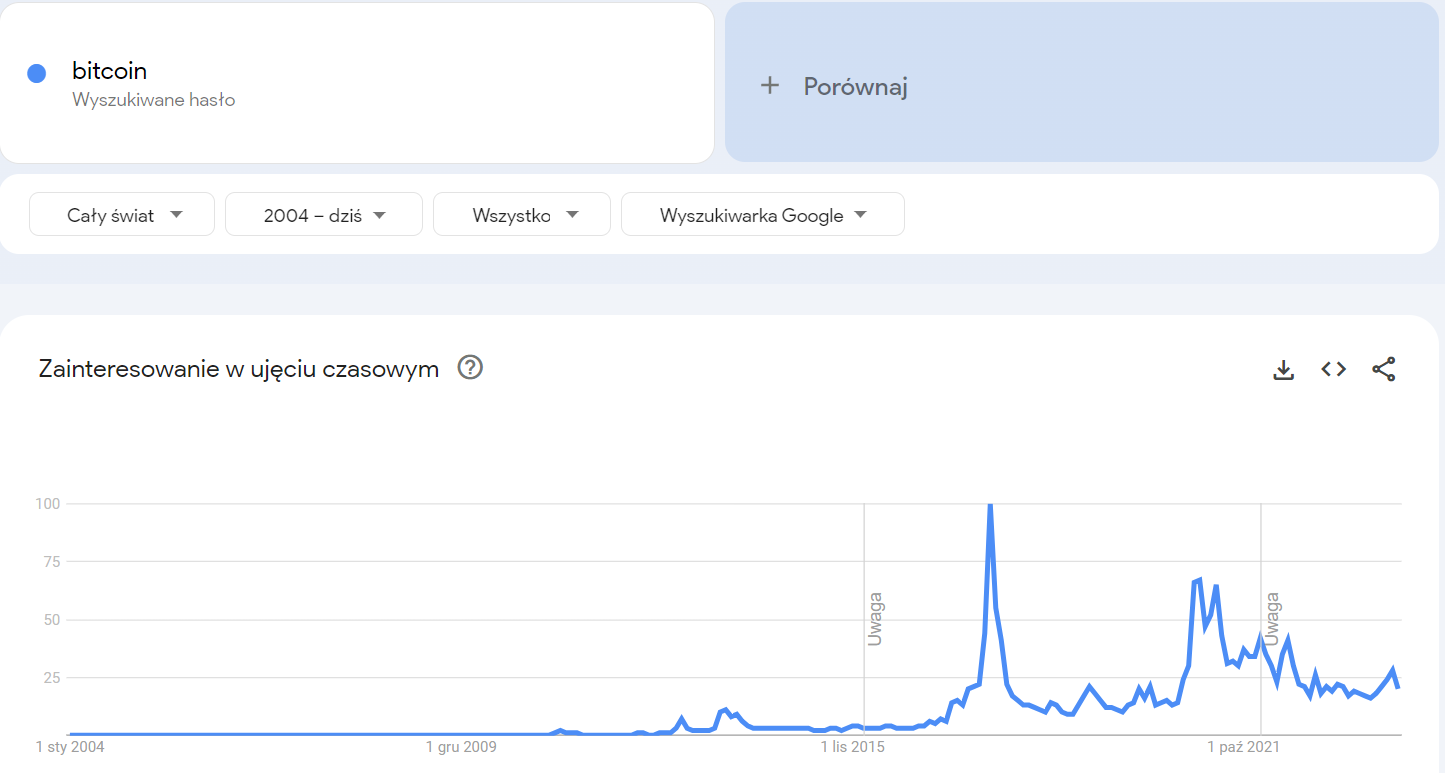

He further points out that “individual investors are not yet very interested in the BTC rate.”

This is not 2017, as suggested by the average search rate for bitcoin in the Google Trends chart

– added.

Or maybe everything is still the same?

If we look at the Google Trends chart and data regarding the search term “bitcoin”, we will see that in 2020 (i.e. the same period as the current period) the interest in BTC was also not very high. The shot took place only at the turn of 2020 and 2021.

The year 2017 indicated by the zondacrypto expert was special. Then (in December 2017, to be more precise) there was a short peak in BTC popularity, followed by a crash, also on stock exchanges.

From the above charts it can be concluded that we are currently waiting for “street” investors, i.e. new, less experienced investors, to enter the market. They will probably appear after breaking the level of USD 100,000, or even earlier, when 1 BTC is at USD 70,000, i.e. after breaking the resistance in the form of ATH.