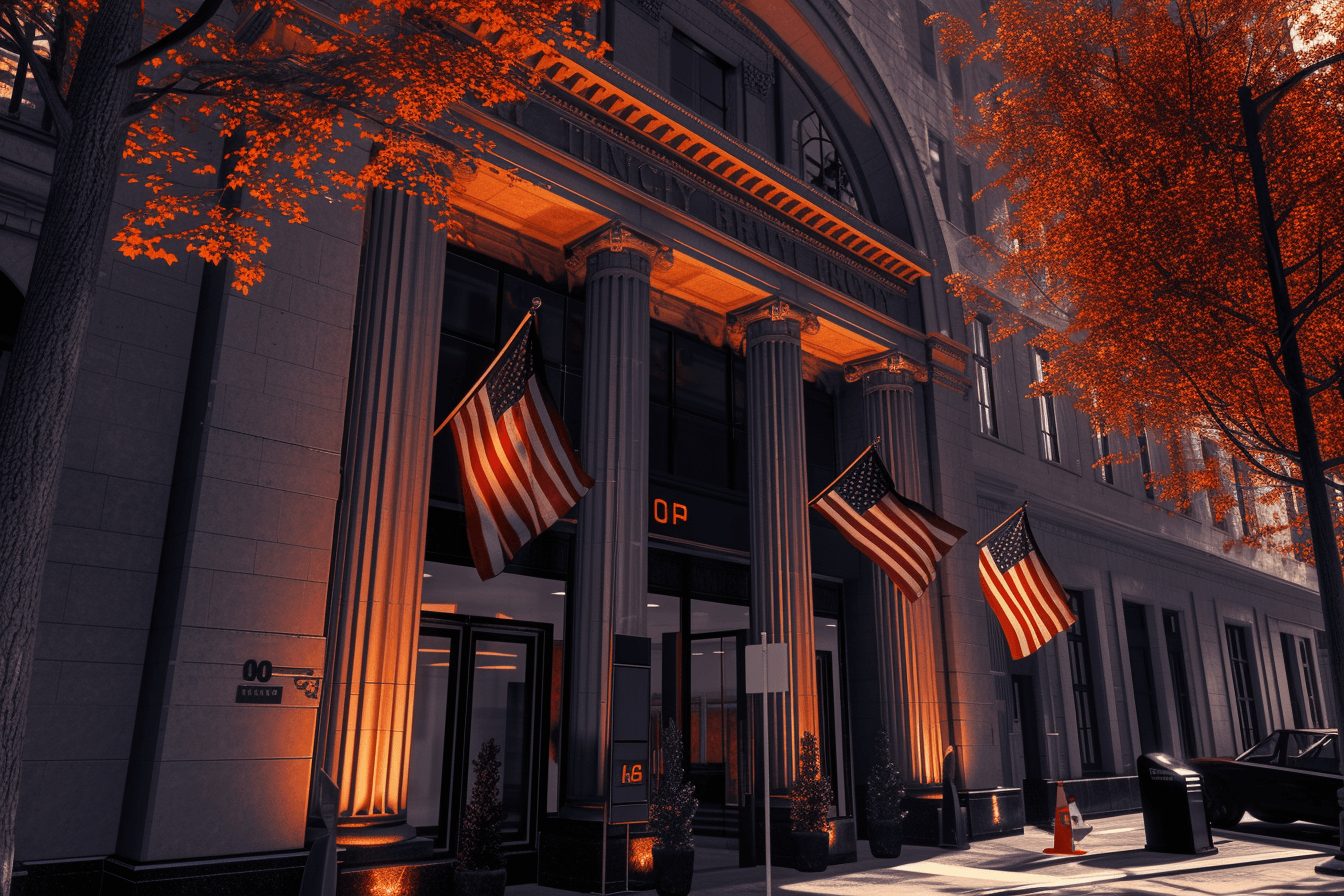

Vast Bank, the first US bank to allow customers to store cryptocurrencies, made a strategic decision. Withdraws from the digital currency market!

Vast Bank tells cryptocurrency investors to “stop”

Vast Bank was the first banking institution in the United States to allow its customers to buy, sell and hold cryptocurrencies. Now, however, it is withdrawing its mobile cryptocurrency banking app from the market. Additionally, it plans to completely withdraw from the digital assets industry.

In response to the most frequently asked questions posted on the bank's website, Vast Bank stated that it would return the remaining cryptocurrencies in its addresses to each holder:

(…) we are disabling and removing the Vast Crypto Mobile Banking app from Google and Apple, which means that your Vast Crypto Mobile Banking account, including any digital assets stored in it, will be terminated and closed.

Vast Bank entered the cryptocurrency market in 2019, and earlier – in 2021 – it worked with Coinbase and SAP on a special mobile banking application that would support cryptocurrencies.

So why is Vast Bank withdrawing from the digital asset market? Supposedly, this is the result of “unsafe or unhealthy practices” related to risk management and control being noticed in the way the bank operates. As a result, the Office of the Comptroller of the Currency (OCC) suggested that the institution pay attention to cryptocurrencies and the risks associated with them.

In November 2023, shortly after the release of the OCC document, Vast Bank issued a press release indicating that it was refocusing its efforts on “traditional banking” and exiting the cryptocurrency market:

Starting in 2019, Vast added a range of digital banking services to its lineup. However, the constantly changing and unclear legal environment regarding digital banking, combined with macroeconomic difficulties, make it more difficult to predict future growth.

Regulatory uncertainty

Vast Bank mentioned regulatory uncertainty in the US. Many analysts attribute this to the general reticence of the American banking sector, which is still afraid to make larger investments in cryptocurrencies and offer the latter to its clients.