“Centralization means concentration of risk,” said Hester Peirce, commissioner of the U.S. Securities and Exchange Commission (SEC), speaking at the ETH Denver event.

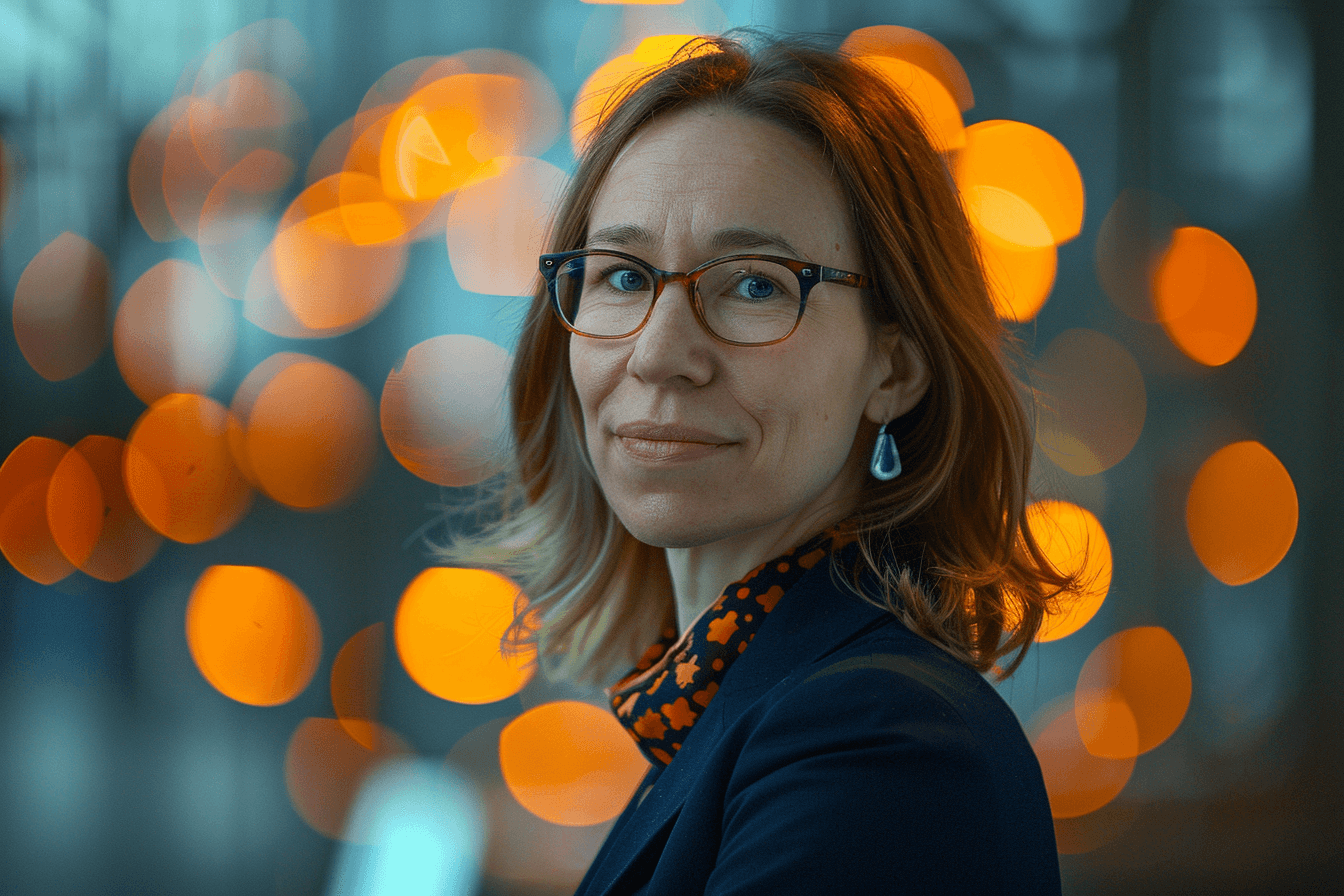

Hester Peirce is in favor of decentralization

Hester Peirce argued for greater decentralization in the US financial system and a more lenient approach to cryptocurrency regulation. Her suggestions were made during ETH Denver.

Centralization means concentration of risk

– she said, adding that “decentralization can actually provide resilience and strength to the financial system.”

That's why I would like to see more resilience and strength… centralization points always keep me from sleeping well at night

– she said.

Crypto Mom

Peirce, nicknamed “Crypto Mom” for her affinity for cryptocurrencies, is a lawyer who was appointed to the Securities and Exchange Commission by former President Donald Trump. This happened in 2018. Since then, she has repeatedly suggested that the blockchain market should be regulated liberally and support its development.

Today, he again expresses concerns about how Washington wants to regulate the industry. She pointed to proposed legislation that aims to treat elements of decentralized technologies (blockchain validators, cryptocurrency wallets, pools) in the same way as financial institutions.

This is disturbing

– Peirce said.

She also pointed out that the problem results from the mentality of officials.

The whole concept of decentralization contrasts greatly with what we are used to at the SEC. When people collaborate and someone is interacting with code rather than with a person or entity, the real challenge for the SEC is figuring out what to do with it

– she added.

Then she said:

Our job is to determine where securities laws apply, to help people be informed when it comes to securities, and then let people make their own decisions.

Recall that in early February, the Securities and Exchange Commission adopted rules that require more market participants to register on its register and comply with federal securities laws, which would provide DeFi with greater oversight.