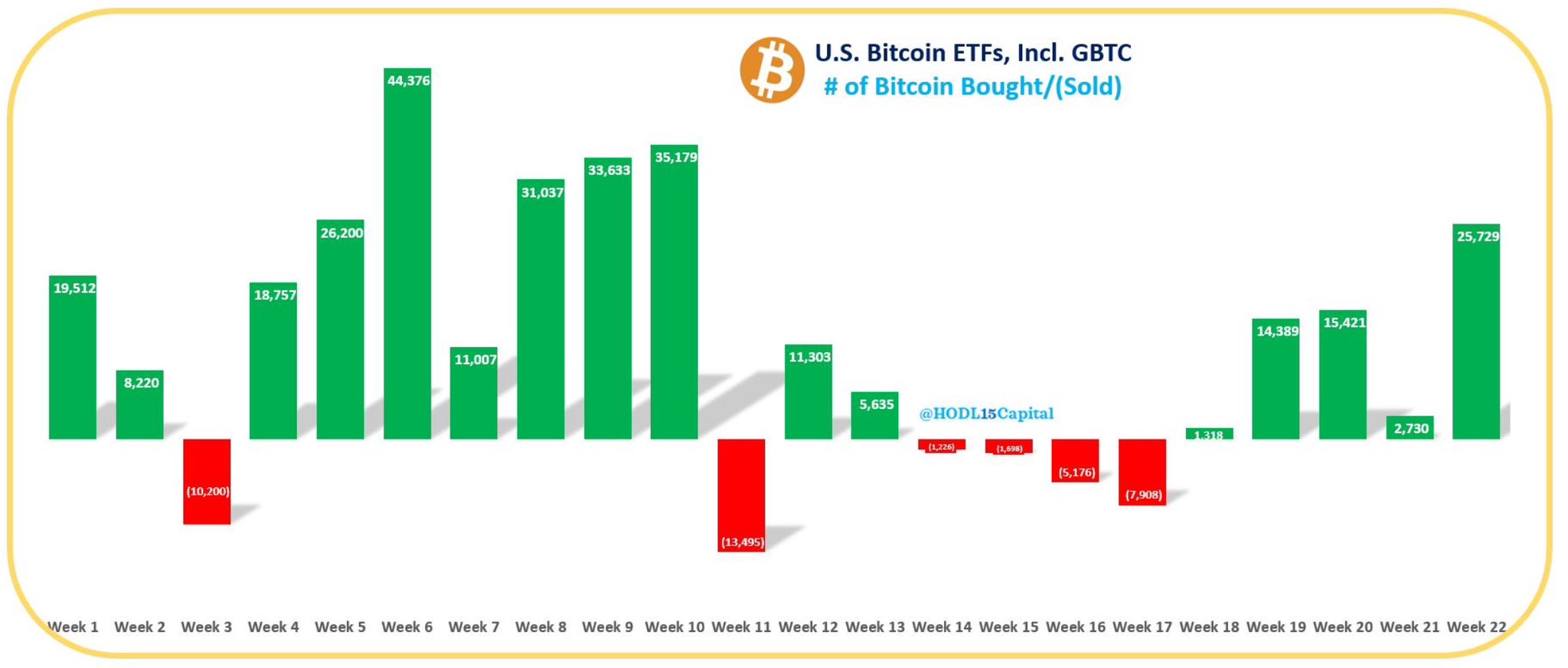

It's really amazing. During the first trading week of June, 11 BTC ETFs purchased approximately $1.83 billion worth of bitcoin. This gives us as many as 25,729 bitcoins.

ETFs buy bitcoin

To understand the scale of what happened from June 3 to June 7, it must be added that ETFs acquired almost as many coins then as during the entire month of May (then it was 29,592 BTC). It hasn't been this good since mid-March, when bitcoin registered new ATH.

The above data may be encouraging, especially in the context of the fact that initially the increases in the BTC price were suppressed by the Grayscale ETF. Or, more precisely, investors who “extracted their bitcoins from it and sold it on the market. However, the fund has already sold out. Now all 11 ETFs can drive growth. Of course, by purchasing coins from the market. There is then less left for “non-ETF” investors. With increasing demand and decreasing supply, the price of bitcoin must increase. There is no other way.

Current market situation: the price is not growing despite strong foundations

Despite such good news, the bitcoin price is still not rising. Why? The demand is simply still too low. However, the current reaccumulation is an introduction to a further wave of growth. There are many indications of this.

Today, 1 bitcoin costs approximately USD 69,350, which translates into zero change on a daily basis and an increase of a “staggering” 0.2% in 7 days.

However, the Bulls do not decide to storm north. The reason may be waiting for the Fed's decision. The US central bank is scheduled to release information on Wednesday about what it intends to do with interest rates. There are many indications that these will not be changed.

Is the market waiting for the first cuts? Possible. Then we will wait for another strong wave of bull market until the last quarter of this year. Until then, we may face… boredom. Yes, “oyster mushroom” with possible spurts in one direction or the other.