The Bitcoin price is once again preparing to attack the USD 70,000 level. It currently remains above the former ATH.

Bitcoin price ready to move forward?

Bitcoin price remains above the ATH from the previous cycle. It currently costs approximately USD 69,555, which means a price jump of 1.5% since yesterday and by as much as 13% on a weekly basis.

Ether is doing just as well. Today, a latecomer investor has to pay USD 3,951 for 1 ETH, which translates into a 0.3% increase in 24 hours and 16% in 7 days.

Moods

Moods? These are still great. The Bitcoin Fear and Greed Index is 79, which translates to extreme greed (“Extreme Greed”).

There is even more enthusiasm on the ETH market. The fear and greed index of ether is 82, which also indicates extreme greed.

It is possible that such good moods on the ether trading floor are not only due to the fact that the cryptocurrency rate is rising. In addition, on March 6, employees of Grayscale and the Coinbase exchange met with representatives of the US Securities and Exchange Commission (SEC). It was about talks regarding the transformation of Grayscale's ETH trust into a cryptocurrency spot ETF, which is the same process that took place earlier this year in the context of the company's bitcoin entity. As you can see, the procedure for creating Ether ETFs is in full swing and is similar to that which took place in the case of BTC, which suggests that funds will be created. This means that new capital will enter the Ethereum market.

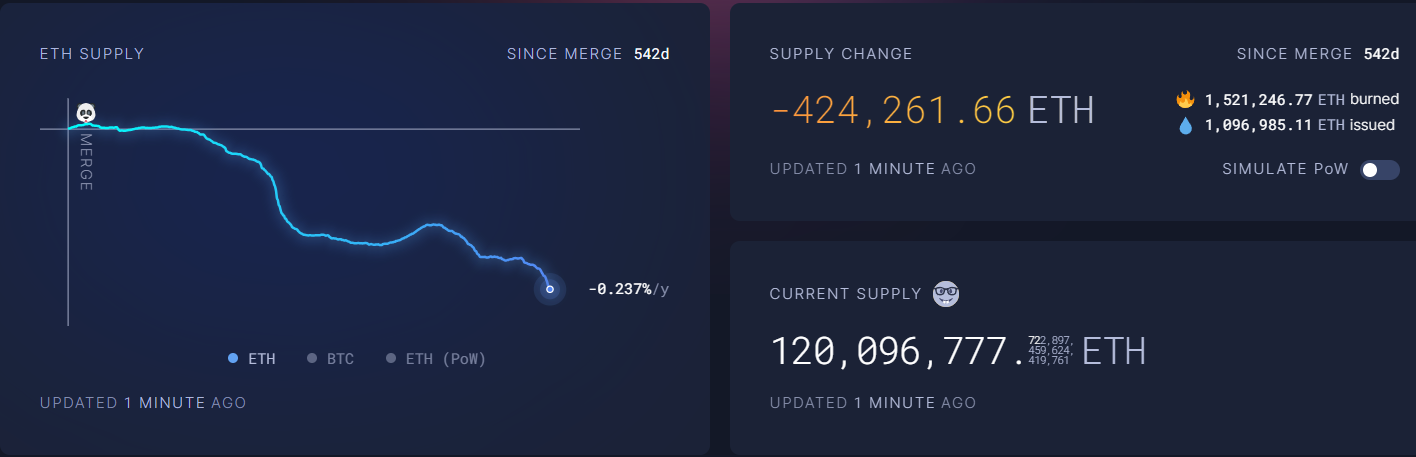

In addition, the supply of ether is still decreasing, which is the result of changes in the issuance of these coins.

Returning to bitcoin, it is worth adding that a permanent breakthrough of the USD 70,000 level seems to be a matter of time. This means that at the end of the year the exchange rate may be at levels that seem unrealistic to us today.

The above text does not constitute investment advice.