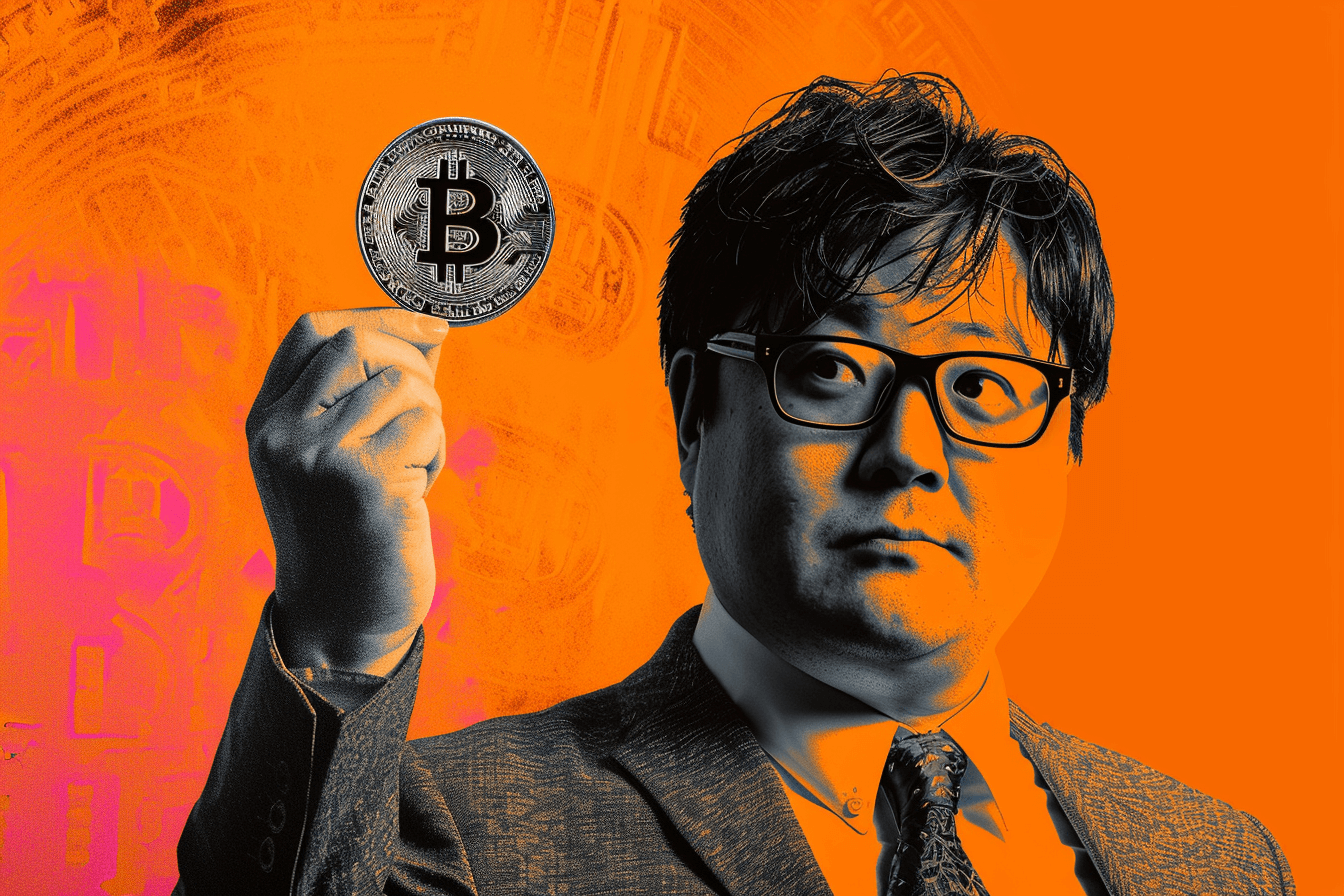

Tom Lee believes that this year we will have to pay as much as USD 150,000 for bitcoin.

Tom Lee remains a bull

In an interview with CNBC, Tom Lee, managing partner and head of research at Fundstrat Global Advisors, presented his latest BTC price forecast. He considers a six-digit BTC price to be a certain “social minimum” for this year:

We (at Fundstrat) believe that bitcoin is still in the early stages of growth, so the idea that it could hit $150,000 this year is still within our base case.

Today, one bitcoin costs just over USD 67,000. This would mean a jump of over 100% by the end of the year. Is it real? If we look at the chart from a broader perspective, the answer should be yes. If the scenario from the previous boom repeats itself, strong growth is still ahead of us and will begin in the last quarter.

Will the Fed give us a boom?

But let's get back to Lee's prediction. In his opinion, bitcoin will start to become more expensive thanks to… the Federal Reserve. In his opinion, this will start cutting interest rates. and this will drive the markets.

I think this is how the markets will recover

– he suggested.

However, the matter is more complicated today. This week we learned the minutes, a report from the last meeting of the Fed authorities. What does it mean? That the US monetary authorities see that the war against inflation is not won. This means that interest rates need to be cut. in the USA will not happen as quickly as we expected at the beginning of the year. It is possible that in 2024 there will not be even three reductions, but at most one. And yet in December 2023, Fed reports showed that we could expect these three cuts.

Today, one bitcoin costs $67,300, which means a price jump of 2.5% for the week and a decline of 3% since yesterday.

The fear and greed index is 74, which indicates investor greed.