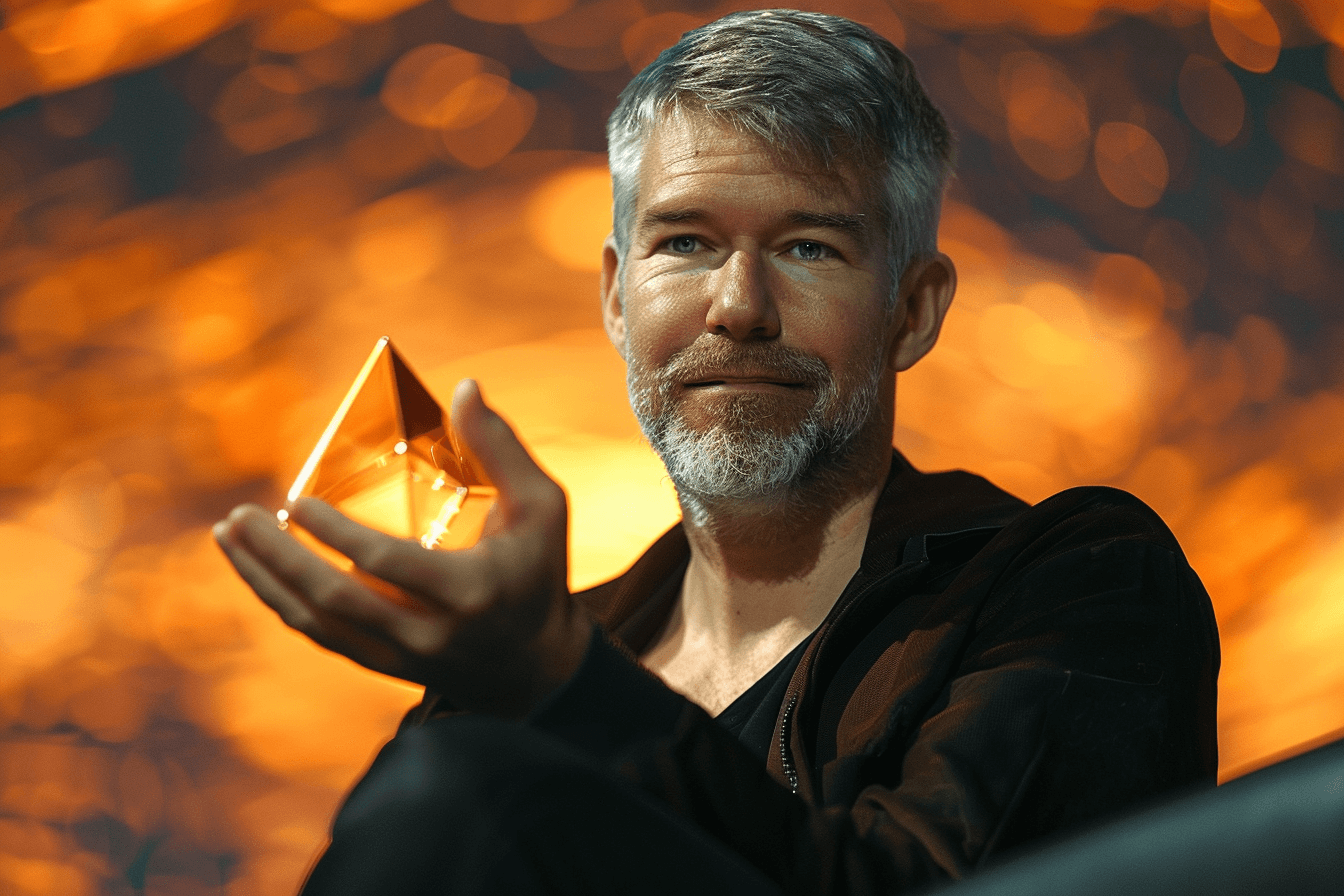

MicroStrategy founder Michael Saylor suddenly changes his approach to Ethereum. He believes that the creation of ETH ETFs is good for bitcoin.

Michael Saylor always sees the bright side of life

This week, the SEC agreed to the creation of ETH ETFs. Saylor, the bitcoin maximalist, shouldn't be happy about this.

Is this good for bitcoin or not? Yes, I think it's good for bitcoin. In fact, I think it might be better for Bitcoin because I think we are politically much stronger, supported by the entire cryptocurrency industry

Saylor told Bitcoin podcaster Peter McCormack.

Ether ETFs “serve as the next line of defense for bitcoin,” the MicroStrategy founder added. He also stated that it will “accelerate institutional adoption” as previously cautious investors now recognize cryptocurrencies as a fully legal asset class.

Saylor believes that a new group of people in the cryptocurrency market will now spend their money on various digital assets. Maybe they will “allocate” 5 to 10% of the entire portfolio for such an investment. He believes that 60-70% of this will still be bitcoin.

He admitted that he previously expected that the SEC would reject applications for the creation of ETH ETFs.

Two weeks ago, the world looked as if Bitcoin was about to be the only asset offered as a spot ETF by the Wall Street establishment and was about to spread as the only legal cryptocurrency.

– he explained.

Change of tone

The point is that Saylor predicted that the SEC would classify ETH as a security. After all, this was the fate that awaited all tokens and cryptocurrencies. Outside of Bitcoin. And here Saylor was a maximalist.

None of (these tokens) will ever become the basis of a spot ETF, none of them will be accepted by Wall Street, none of them will be accepted by mainstream institutional investors as crypto assets

– he spoke early May Saylor.

The cryptocurrency community believes that Saylor's change in narrative may also mean a change in the strategy of his company that invests in bitcoin.

Cryptocurrency analyst Ricky Bobbyy suggested that “Saylor's next step will be to purchase ETH. This is a major 180-degree change.”