Bitcoin or gold? For some strange reasons, some people believe that these two assets compete with each other. However, this is not true. And in this text I will prove it.

Gold vs. bitcoin?

When reading discussions on social media, I sometimes get the impression that investors are not much different from fans. They also support their favorite assets with great enthusiasm (after all, it's often about big money!), and they also like to mock “fans” from another market. For example, the gold “ultra” will be happy to make fun of the bitcoin maximalist, and the latter will not remain indebted to him.

But an experienced investor doesn't do that. He knows that the investment basket should include various assets that will complement each other. Gold, silver and bitcoin in one trader's wallet? Yes, this should be standard.

It is increasingly becoming apparent that investing in Bitcoin does not exclude, but even logically supports, traditional investments in gold

– shows us the company Cashify Gold, which allows trading in gold.

And in fact, gold and silver are perfect for acting as an iron reserve. We should have a certain percentage of our savings in them. Precious metals will help us store the value of some of our capital. We will earn in USD or PLN, but in practice we will store the value that fiat currencies regularly lose due to inflation.

Bitcoin, called by many digital gold, is a form of investment offering a much higher rate of return, but it is exposed to quite high price fluctuations and cyclical declines.

Having the appropriate percentage of physical gold in relation to the digital asset such as bitcoin seems to perfectly balance a modern investment portfolio resistant to inflation or economic collapse, while being attractive in times of bull markets. Old school experts like Peter Schiff still don't seem to understand such a modern concept

– adds Cashify Gold.

Since Schiff's name was mentioned here… Yes, this is the type of investor who does not understand that owning gold does not exclude investing in BTC. And conversely. He constantly criticizes cryptocurrencies and… loses his chances of increasing his capital.

The current situation

Let's look at the current situation on both markets. Bitcoin broke the USD 30,000 barrier in October last year. Today, one coin costs USD 67,000. Over 100% earnings in a few months.

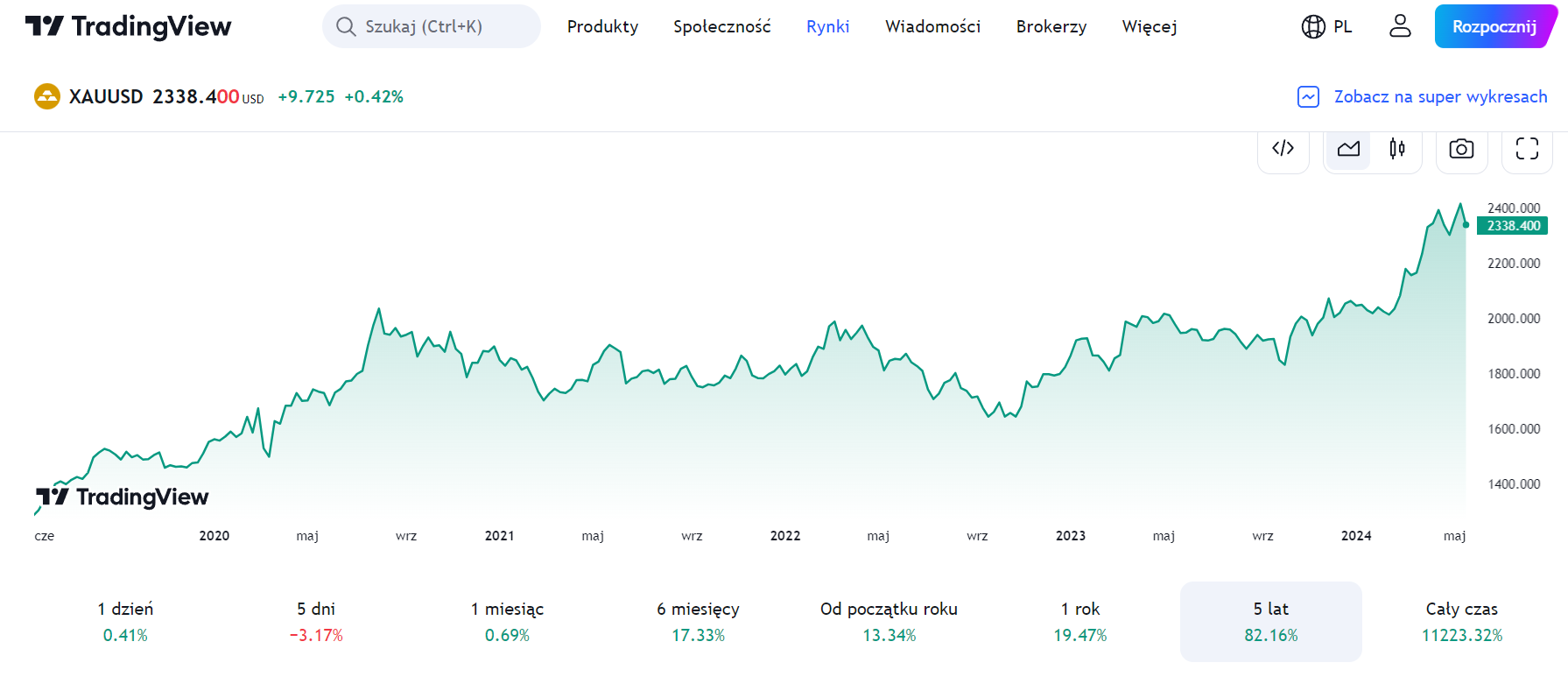

Gold began its ascent around the same time.

In the case of gold, it is difficult to talk about such a large profit as bitcoin investors can boast of. The metal of kings has not recorded 100% growth even on a 5-year scale (although it is close). But that's not the point. In the case of this asset, it is about storing the value of savings. If we kept these in fiat currencies, we would lose a lot – due to inflation.

There are also interesting situations. Piotr Bień from Ari10 noted yesterday in a post on LinkedIn how bitcoin and gold reacted in an interesting way to new news from the Fed.

Yesterday we learned the minutes, i.e. the report from the last meeting of the US central bank. It shows that the Fed authorities see that they are not doing well in the fight against inflation, hence they do not rule out a delay in starting the process of cutting interest rates.

The Fed is now hitting gold and silver, but not bitcoin and ether. We learned the content of the new protocol. The new Fed report shows that the war on inflation in the US is not won. The minutes show that “various participants mentioned a willingness to tighten policy further if risks to inflation materialized in a way that would make such action possible.”

The price of gold is falling and so is silver. Bitcoin? Bitcoin is worth the same today as it was yesterday. #Ether is getting more and more expensive. 1 #ETH is worth $3,870, which is about 4% more than yesterday

– Bień noticed.

And in fact, in response to the new report, the price of gold fell yesterday (also silver), while the price of bitcoin remained stagnant. Ether was rising in price (awaiting the SEC's decision regarding ETFs).

What does the above tell us? The fact that BTC can be an even harder safe haven than gold. In the long term, as I have shown, it generates higher returns for investors. Which, of course, should not rule out precious metals, which are perfect anchors for an investment portfolio and create the ground for more risky investments.