The beginning of April greets us not with green, but with red. Bitcoin price dropped below $67,000. Why?

Bitcoin price is falling due to…

Bitcoin currently costs approximately USD 66,800. This translates into a 3.66% decline over 24 h and 4.86% within a week.

Ether, in turn, costs USD 3,377, which means a drop of 4.5% since yesterday and about 7% over 7 days.

The latest sentiment surveys were conducted at a price of approximately USD 69,500. Hence, the fear and greed index was 79, which means extreme greed. The new analysis will certainly show a decline to “ordinary” greed or even indifference.

Let's move on to the reasons for the decline. Everything we see on the chart is still a quite natural correction of the increases we observed earlier.

It is worth recalling the past at this point. In March 2020, there was a much more dramatic correction, which was driven by the COVID-19 pandemic and lockdown policies (in practice, freezing the economy).

The current correction looks much more natural and is probably just an attempt to clear the market of “weak hands”.

Is this about the Fed?

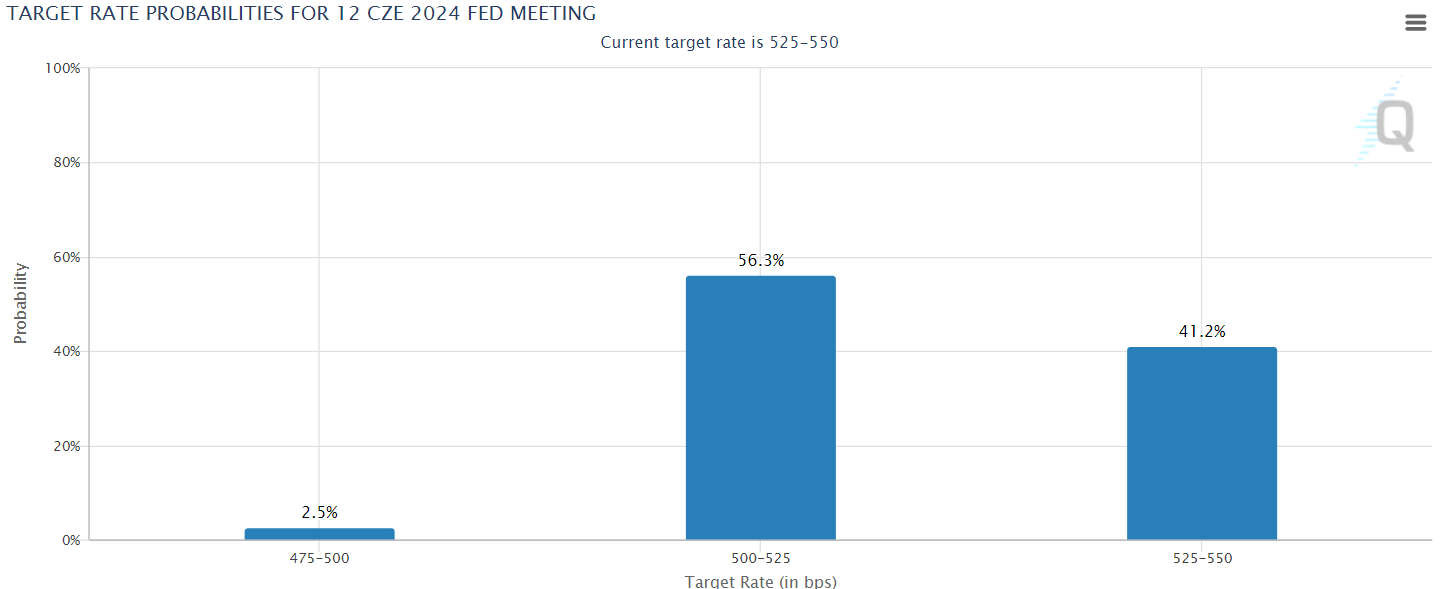

Of course, we can also try to look for other reasons for the declines. The market is losing hope that the Fed will start cutting interest rates. in June. Currently, the probability of the first cut on June 12 is estimated at just over 56%. There is also a 41 percent risk that rates will be left at current levels.

However, even if there are no reductions in June, they will take place a little later. Since December, the Fed has maintained that it will cut interest rates three times this year. A secondary issue will be whether the first cut will take place in June or July.

In the background, we see gold increases. Today, one ounce costs USD 2,274, which is almost the highest price in the history of the metal of kings.

The above text does not constitute investment advice.