The bitcoin rate broke the level of USD 64,000 overnight. Then there was a correction and… another attack on this level. This time it was so successful that 1 BTC currently costs latecomers a little over USD 65,000.

The Bitcoin price does not like to stand still

You probably fell asleep smiling. Bitcoin broke through the USD 64,000 level. The morning was brutal. 1 BTC cost less again. But it was enough to wait a few hours to see the cryptocurrency break through USD 64,000 and then USD 65,000.

The situation is very dynamic. Currently, one bitcoin costs just over $65,000. This means a 5% jump since yesterday and a 26% weekly increase.

Ether has also woken up and is trading at $3,522, up 3% on a 24-hour scale and 13% in 7 days.

At the mood level, we have enormous enthusiasm. The Fear and Greed Index is 82, which means extreme greed.

Even though ether is rising more slowly, the Ethereum Fear and Greed Index shows 83, which means even stronger extreme greed.

Are ETFs buying?

What is the reason for these increases? This is probably the result of ETF purchases and the general supply shock that the market is experiencing today. Glassnode reported that on March 2, the number of BTC held on exchanges dropped to 2,286,347 BTC. This is the lowest since March 2018.

As you can see, bitcoins are disappearing from trading platforms, probably bought by institutions, ETF issuers and more aware investors.

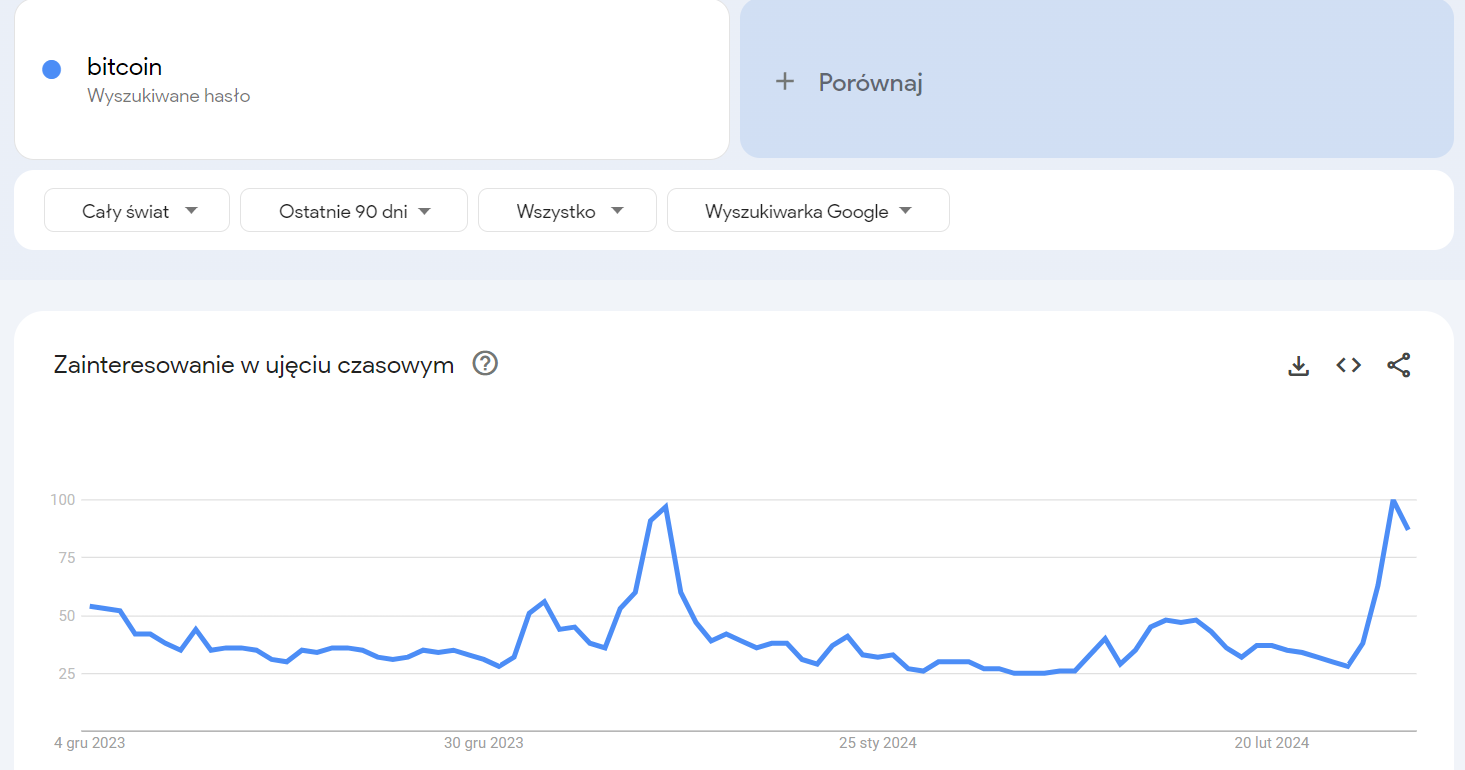

The “street” is probably not coming back to the market yet, but there is a certain increase in interest in bitcoin.

Is there a correction ahead of us?

Everything looks too good. What is worrying is the good mood, which may herald a stronger correction. On the other hand, even macroeconomic data are good (falling inflation in the US) and may suggest interest rate cuts. in the USA, which will further fuel growth. Not to mention the halving, which will take place on the network in just 51 days and will further reduce the supply of new bitcoins, which is already too small for the current demand.