Did someone here talk about the decline in capital inflows into Bitcoin ETFs? A Fidelity fund just asked you to hold its beer, and… it's seeing the biggest jump in deposits in the last two weeks.

Bitcoin ETFs are back in the black

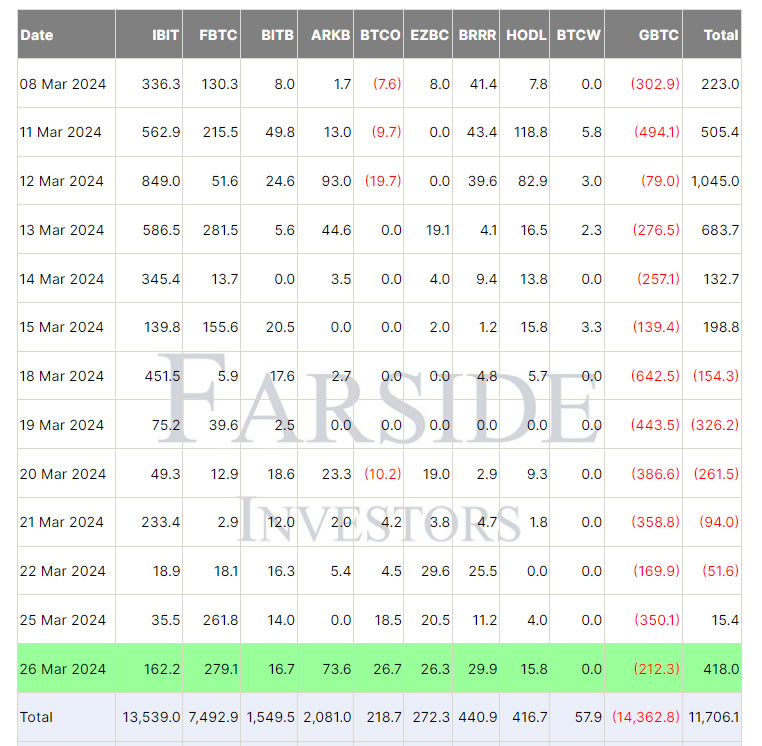

According to data from Farside Investors, ten Bitcoin ETF funds can boast a total daily net capital inflow of USD 418 million after yesterday, March 26.

The Fidelity fund entered the stage all in white and showed off the largest daily jump in capital raised since March 13. It concerns as much as USD 279.1 million that was transferred to it. This gives approximately 4,000 BTC. It was the second day in a row that the fund recorded inflows of more than $260 million.

Against this background, the BlackRock ETF performed poorly – its account received “only” USD 162.2 million. However, its daily inflows remain low compared to the amounts recorded earlier this month (an average of over USD 300 million).

The Ark 21Shares Bitcoin ETF had its best day since March 12, recording inflows of $73.6 million, while Invesco Galaxy, Franklin Templeton and Valkyrie recorded inflows of more than $26 million.

How does Grayscale's GBTC fund fare in this context? He's still bleeding out. This time, the daily capital outflow was $212 million. Fortunately, this time it turned out to be too little to burden the market.

Since converting the company's trust into an ETF, Grayscale has lost a total of 277,393 BTC, worth approximately $19.5 billion (at current prices).

Welcome to the land of giants

In a post from March 26 on X Bloomberg senior ETF analyst Eric Balchunas noted that BTC ETFs are currently among the largest such products. He added that even the Bitwise Bitcoin ETF (BITB) – is currently the 18th largest ETF in terms of assets under management. This is higher than, for example, the SPDR Gold Shares fund (GLD).

We also have a potential “yes” from US officials to ether ETFs, which – if they are created – may cause confusion on the market.